A Front Line Account of M&A in a Covid-19 World

Executive Summary

When Covid-19 first hit, M&A activity froze: cancelled transactions and paused deals

created a bleak outlook. In the midst of this negative and panicked environment, our

perspective on the potential for M&A was bullish, and in May we shared our first thoughts on how M&A would rebound from this pandemic.

The last few months have validated our perspective. As shown in the transaction numbers, and in the activity of EthosData’s data room clients, M&A activity is back on the rise and, we believe, set for potentially record highs over the next 18 months.

This is a reflection of the underlying economic situation, investor interest, the need for companies to adapt and digitize, the amount of liquidity in the market, and a well-funded and eager-to-invest private equity sector.

It won’t all be smooth sailing. Further Covid-19 outbreaks and bumpy US presidential politics may create uncertainty and pauses in activity. However – as was the case

following the 2008 financial crisis – a number of promising opportunities will arise for

companies who are prepared, flexible, and have good technology in place (such as

VDRs).

What M&A looks like today

What a decade this year has been!

Back in May 2020, with many countries in the middle of their Covid-19 lockdown, we

wrote a whitepaper forecasting a jump in M&A activity following the initial impact of

the virus, a prediction that has been proven right in recent months.

This was after three months (March, April, May) of little to no activity caused by an uncertain present and an unclear future – an environment in which business leaders hate to make decisions.

Many deals were cancelled, some were put on hold, and a few were rushed through as companies looked to restructure and find liquidity. Reuters reported that activity

plummeted 28% in the first quarter of 2020 to its lowest level since 2016.

Businesses midway through an acquisition faced numerous obstacles to completion:

valuation gaps, cash flow concerns, access to funding, and the inability to meet with

advisors and investors face to face.

Despite all this, in May we were optimistic about M&A activity for the remainder of the

year and 2021, drawing comparisons with the Spanish Flu and 2008 global recession to predict how the world of M&A would come through Covid-19. Both of these events took very different paths to recovery. Yet it was their very recovery which gave us reason to be positive.

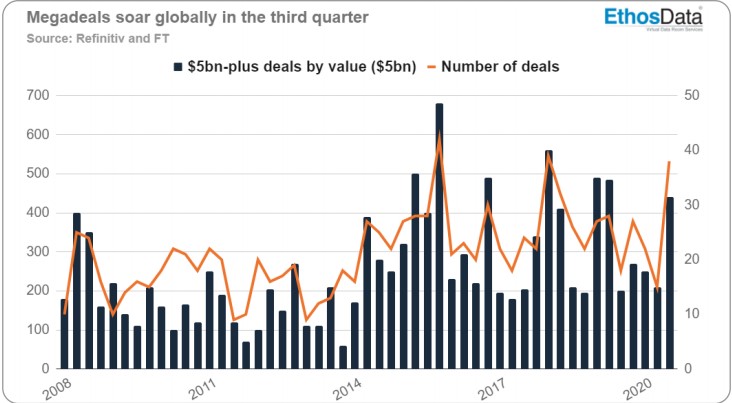

M&A activity between 2008 and 2018 was able to reach uncharted realms of success

in arguably its toughest decade to date. What’s more – unlike with the 2008 recession – the current economic issues facing us did not originate in the financial markets.

Therefore the financial sector should be much better placed to provide financing and

support to businesses following Covid-19.

The predictions in our whitepaper in May were right. We have seen a large upturn in

activity, especially towards the end of Q3, making us even more optimistic about the

next two years. Five months on from that whitepaper, and seven months on from most countries first entering lockdown, it’s time to reassess the impact of Covid-19 on M&A activity.

- What has happened so far?

- How has M&A activity been affected?

- What will M&A activity look like as we finish 2020?

- What can we expect to see in 2021 and beyond?

- How can companies and advisors prepare for the months ahead?

This whitepaper will answer those questions.

But, before getting to all that…

Broadly speaking you can place the M&A activity which has taken place between March and September into one of three categories:

- Deals which were in the pipeline before Covid-19 and still made commercial sense.

- Distressed M&A deals which companies have had to complete in order to survive.

- Future-looking deals that companies have made, or are making, in order to thrive in the new world (i.e. new ways to do retail or healthcare).

In the next section we’ll explore some of the deals that have (and haven’t) taken place, and turn our attention to 2021 and beyond.

A monthly breakdown of M&A Activity post-Covid-19

March – May

1. The initial freeze

During the second quarter of 2020 global dealmaking dropped to its lowest levels

in over a decade, with Covid-19 bringing an end to one of the longest periods of

sustained M&A activity.

A June M&A Leadership Council survey reported that over half (51%) of C-level

executives and senior corporate development leaders indicated there was a

“temporary pause” on their current deal activity. Meanwhile, as doubts over valuations grew, and with companies focusing on cash preservation, a number of early-stage auction processes saw bidders immediately withdraw.

This pause was compounded by dealmakers not being unable to conduct in-person

meetings and the increased scope of due diligence. As uncertainty in the financing

markets grew, many felt uncomfortable pressing ahead with deals. According to

Refinitiv, only $485bn worth of deals were made between April and June 2020 (down

50% from the same period in 2019).

Meanwhile, when it came to deal values, patterns across industries varied widely.

The one common trait? The majority were down. Bigger deals, and mega-deals, also

stopped. In the first half of 2020 M&A deals above $10bn were down 60% from the

same period in 2019.

2. Dead deals

Both deal activity and size decreased as a result of Covid-19. 66 M&A deals were canceled between March 11th (when the World Health Organization

declared Covid-19 a pandemic) and April 6th. Most were all-cash deals involving Asia Pacific and North America targets. One high-profile cancellation includes Boeing’s $4 billion acquisition of 80% of Embraer’s commercial jet business, and a 49% stake in a joint venture producing a new military cargo jet.

A word to the wise

Cancellations have continued in recent months.Early in September LVMH walked away from its 2019 deal to acquire US Tiffany & Co. for $16.2 billion, triggering a dispute between the two. Tiffany is suing LVMH in an attempt to force through their deal, with LVMH filing a countersuit claiming Tiffany is no longer the business it agreed to buy last November.

As this case demonstrates, if you’re working on a deal then make sure all your documents are recorded, tracked, and safely stored in a powerful virtual data room (VDR). This could protect you from claims further down the line.

May – September

The somewhat bleak outlook changed dramatically as we moved into the second half

of the year. Having absorbed the initial impact of lockdown restrictions, the world had

adjusted to Covid-19 and started to open up again.

1. There’s no place like home to complete a deal

As some countries started to come out of lockdown, May saw a number of M&A transactions restart (although many with renegotiated terms). Across all industries deals that were close to completion resumed. Although – from our discussions with clients – the cadence and processes changed substantially. Uncertainty, and having to run deals from home, were the two main factors given for this change.

Of course, there was less buyer competition in certain situations. This was in part

due to people not being able to meet face to face, and some of our data room clients

mentioned that they were more focused on a lower number of buyers who they felt

were more likely to close.

Things changed from June. Many high-value deals were announced (more on these

shortly) and M&A activity picked up. June and July each registered more than $300bn in overall M&A activity, compared with $100bn in April and $130bn in May (according to Refinitiv data). What’s more, in July and August eight deals all larger than $10bn were announced (according to the Financial Times).

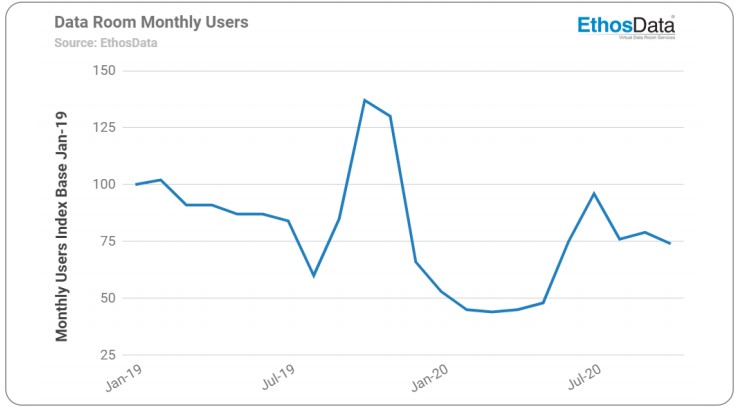

This upturn in M&A activity is reflected in our own data. Only a very small number of

EthosData clients (less than 4%) closed their data room in the first half of 2020. This

was because very few thought their deal would completely die and so they either

hunkered down or pushed through at a slower rate.

In fact, the level of client activity and usage of our data room service dramatically increased in June, to a level not too far from June 2019. This increase continued in July, and even surpassed July 2019’s figures.

2. Exploiting attractive M&A areas

Despite some price uncertainty and a worrying economic outlook, companies with

strong balance sheets, a good stock price, or liquidity options were quick to exploit

attractive M&A areas as we moved into June and July.

M&A activity took the form of:

- Stake sales and corporate carve-outs, with companies looking to ensure liquidity, monetize non-essential assets and strengthen their balance sheet. A good example of this approach was Tesco’s divestiture of its Thai and Malaysian operations.

- Strategic bolt-ons and tuck-ins when a target provides a buyer with strategic resources, new markets, and increased global reach. This is an approach taken by PepsiCo with its acquisition of Rockstar.

- Supply arrangements or long-term joint ventures, some of which were previously planned acquisitions. This can be seen in the strategic partnership between Coty and KKR which will help deleverage Coty’s balance sheet and streamline its operations, and in the joint venture between Carlsberg and Marston’s which will

- result in annual cost savings of around £24 million and allow Marston’s to focus on its pub and accommodation businesses.

Some companies used this moment to take fundamental steps to digitally transform

their business, create new business models for a post-Covid market, or accelerate

the development of their most promising technologies (e.g. Verizon’s acquisition of BlueJeans Network to grow its emerging 5G technology). This is in part why M&A

activity in Industrials, Technology, and Healthcare Pharma has remained solid.

The rise in M&A activity over the summer is also reflected in the number of new

projects people planned with EthosData. For example, in India alone, we saw a 57%

increase in the number of planned projects for June – August 2020 in comparison to

the same period in 2019.

September and beyond

1. Back to school. Back to work. Back to M&A

In the middle of September, stock markets across the world surged after a flurry of

M&A activity. This is only the beginning, with a number of signs that we will see a

continued resurgence of M&A activity in Q4.

Three Notable September Deals

1. ByteDance, the owner of TikTok, reaches preliminary ‘technical partnership’ agreement with

Oracle for TikTok’s US operations.

2. Softbank set to sell microchip designer ARM to

US-based Nvidia for $40bn (having acquired it

for $31bn four years ago).

3. Gilead Sciences, the American pharma giant,

plans to acquire Immunomedics, a cancer drug

developer, for $21bn.

In the June M&A Leadership Council survey a significant percentage said Covid-19

would have no impact on their intent to accelerate deal volume for the rest of 2020.

This was because of the increase in opportunistic targets and the more favorable

valuations which the pandemic had brought about.

Moreover, government support programs such as the UK’s furlough scheme are coming to an end. While many governments will be planning new rescue packages, it’s likely that a number of industries will fall through the cracks as they did in the first round of schemes. This will potentially trigger a number of bankruptcies and insolvencies, especially as the threat of a second wave of Covid-19 looms large. As a result, distressed M&A activity will likely rise.

Alongside this, liquidity continues to be at an all-time high. Banks are lending again,

interest rates are at historic lows, and corporate and private equity firms are at

historic highs in terms of liquidity. We’ll look at this further in the next section.

Right, enough of the background…

It’s time to look into the future. What will M&A activity look like as we finish 2020?

What can we expect to see in 2021 and beyond? And how can you prepare for the

months ahead?

What the next 12-18 months look like in M&A

We are even more bullish about the level of M&A activity to come in the next two

years than we were back in May. This is based on financial data and our clients’ levels of activity. The market is reacting faster than it did following the 2008 financial crisis, suggesting the recovery is going to be just as strong.

Refinitiv data from September shows a total of $1.97 trillion in deal value announced in 2020. After the 2008 financial crisis, and in the same time period, deals totaled ‘only’ $1.26 trillion and $1.6 trillion for 2009 and 2010 respectively.

We would not be surprised to see a record year for M&A activity in 2021. There is lots of liquidity in the market, record levels of cash on US corporate balance sheets, and a well-capitalized private equity sector raring to go. At the end of 2019 global private equity funds had $1.25 trillion of capital yet to be invested and now they are met with a number of sellers eager to restart activity that slowed down at the start of the pandemic.

Of course, there will be some bumps in the months ahead, and two in particular stand out.

The first is simply how countries deal with Covid-19 and how long the effects of the

virus are felt for. M&A activity will be impacted by the rate at which each country

opens up its economy again, and whether it can keep it open despite new waves of

the virus.

The second is the effects of the US presidential election. Any uncertainty brought

about by the election (whether that’s over the actual result, the geopolitical

implications of it, or how the next four years will take shape) won’t stop on election

night. The election will be a much longer process than previous ones, and until we get clarity some may adopt a “let’s wait and see approach.”

These two factors may change the levels of M&A activity at certain points but, over

time, we believe M&A activity will hit record heights come 2021.

What sectors will see the most activity?

We have already seen strong M&A activity in the retail, hospitality, technology,

pharmaceuticals, health, and oil and gas industry. This will continue.

Retail and hospitality

We expect to see an upturn in distressed M&A activity and industry consolidation

within traditional bricks-and-mortar offerings. The wave of new social restrictions and

curfews now sweeping Europe will only accelerate this.

Technology

Society has become more home-centric, and will continue to remain so heading

into Q4 2020, which brings about numerous opportunities for the technology sector.

Companies will use M&A to improve their technology capabilities, whether they’re

looking at remote working, e-commerce, or broader digital transformation projects.

Pharmaceuticals and health

As with before the pandemic, Pharma and health remain attractive to investors. Firstly, this is related to the health response of Covid-19 and the world’s current need for vaccines, therapies, and medical devices. Secondly, it’s linked to how medical services are delivered in the future: Covid-19 has accelerated the importance of robust and reliable digital delivery in a socially distanced world. Companies across these two areas will become targets for acquisitions and tie-ups.

Oil and gas

Covid-19 has led to a fall in oil prices. To avoid filing for bankruptcy some companies

will be forced to merge and the industry will need to consolidate.

And more generally…

Any sector experiencing dramatic operational stress will be ripe for M&A activity and

bidding wars will ensue once a company is ready to maximize shareholder value.

We expect to see a number of small to medium size companies turn to larger and

financially stronger ones for survival, something you can already see in the banking

sector. Low interest rates have put pressure on the margins of smaller banks who are already struggling to make the necessary technology investments to stay competitive.

Consolidating with the larger institutions will be their only way to survive.

Based on this, and with private equity firms looking for opportunistic acquisitions at

depressed asset prices, we expect to see a number of ‘cheap’ deals in the next 18

months.

All of which begs the question: what can you do now to prepare for the months

ahead?

How to prepare for the next 12 – 18 months

1. Get the company ready

As we close out 2020, now is the time to evaluate business goals (and re-evaluate

those set during the downtime of lockdown). There are three fundamentals to answer:

- What’s happened to the company and its sector?

- How is the sector changing and innovating?

- How can you make sure the company is adapting to those changes and customer

needs?

Once you have your answers you can spot the gaps between your current capabilities and your recovery requirements to determine your M&A strategy and goals. Or, if you’re looking to sell, you can identify opportunities and buyers.

Of course, if you’re on the buy-side you’ll need to stress-test this strategy and identify

any potential hazards which may impact your ability to operate or raise financing for

future deals. Three things will be key:

- Having liquidity.

- Thinking carefully about valuations.

- Knowing your sectors and your target list.

2. Prepare for digital deals

Over the next 24 months, deals might change shape based on the financial uncertainty and volatility at a given time (as they did following the 2008 financial crisis).

Transactions may go from IPOs to M&As to asset sales to restructuring, and to be

successful you will need to be flexible. On one occasion you may need to show a

bidder a whole company. On another just a single asset.

Having flexibility comes from being prepared and, in our experience, having a tool that allows you to save time and execute a transaction remotely. A powerful virtual data room (VDR) is one such tool. Post-2008 we saw that those companies who had a good VDR in place were able to make the most of the opportunities that arose.

An example of this is a transaction we worked on in 2008 when one of the Spain`s

biggest banks contracted us to a large subsidiary that had all its mortgage portfolio

and assets. Because of the flexibility our service and team gave them, later on, they

were able to quickly turn the transaction into an asset sale, breaking up the sale into

many separate portfolios.

This transaction flexibility will be crucial given that restrictions, both local and

national, look set to be in place this winter. While there is still a need for meeting the

owners, walking the factory, and talking to employees, you need to be ready to work in a digital world.

Working remotely is now not only required by Covid-19, but it’s commonplace and will continue in the years ahead. The result? Expect much less face-to-face interaction between deal teams and companies. Dealmakers will need to rely more and more on online platforms to share, access, and work on documents. Prepare today by learning about, getting under the hood of, and ultimately picking the right digital providers who can support your deals.

The due diligence process will never be the same again and ensuring you have online access to the right company documents will make or break a deal. You need to pay close attention to who is able to access sensitive data, information that could impact markets, and files which are highly sensitive.

Companies who prepare well will have one thing in common

The advisor/client relationship has changed for good, and deals are more reliant on a

good VDR service than ever before. Now is the time to get ahead of the curve and ensure you and your team have the right remote technology and support in place. Talk to providers, understand their offering, and see how they can help you run a smoother transaction.

As M&A activity starts to ramp up – and given the need for companies to be flexible,

fast, and secure – partnering with the right data room service is more important than

ever. A powerful VDR (like EthosData’s) is the safest, easiest, and most effective way to share documents during a transaction (and global pandemic!).

It’s quick to set up and overcomes the challenge of not having regular face-to-face

contact during any due diligence, restructuring, roadshow, funding round, or IPO process. This is crucial as many countries now head into a second wave of the virus where further travel and contact restrictions are likely.

Thousands of companies use EthosData for a number of reasons (it’s why we’ve operated for over 13 years and handed more than $900bn in transactions).

Amongst other things, our clients say they benefit most from:

Based on previous experiences, and the current situation we find ourselves in, all

signs point to a very busy 18 months (and beyond) in M&A activity. Are you ready?

You focus on your deal. We focus on your documents.

Want to talk about your next deal?